The potential impact of a government shutdown on cash aid programs is a pressing concern, especially considering the financial strain that many individuals and families are already facing. As we delve into this topic, we will explore the intricate relationship between government operations and the crucial safety net provided by cash assistance programs. This analysis aims to shed light on the potential consequences and the broader implications for those reliant on these essential services.

Understanding the Impact: Cash Aid and Government Shutdowns

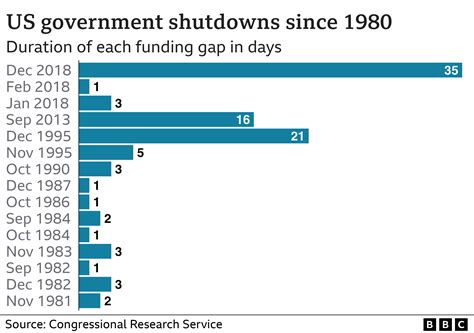

A government shutdown occurs when funding for federal agencies and programs is temporarily halted due to a failure to pass appropriations bills or a disagreement over budgetary matters. While essential services continue to operate, the impact on cash aid programs can be significant, disrupting the financial stability of millions of Americans.

Historical Context

Past government shutdowns have shed light on the vulnerabilities of cash aid programs during such crises. For instance, during the 2018-2019 shutdown, the Supplemental Nutrition Assistance Program (SNAP), commonly known as food stamps, faced a potential funding lapse. This program, which provides vital food assistance to low-income households, was at risk of running out of funds, leaving millions without access to this essential benefit.

Current Concerns

As the threat of a government shutdown looms, the question arises: how will cash aid be affected? The answer lies in the intricate web of federal funding and the specific programs at stake.

Key Cash Aid Programs

Several federal programs provide cash aid to individuals and families in need. These include:

- Temporary Assistance for Needy Families (TANF): TANF is a block grant program that provides funding to states for various assistance programs, including cash aid, child care, and employment services. During a shutdown, TANF funding is generally considered non-discretionary, meaning it continues to operate as long as states have sufficient funds in their reserves.

- Supplemental Security Income (SSI): SSI is a federal program that provides monthly cash assistance to eligible low-income individuals who are aged, blind, or disabled. SSI benefits are considered mandatory spending, which means they are typically exempt from the effects of a shutdown.

- Unemployment Insurance (UI): UI programs, administered by states, offer temporary financial assistance to individuals who have lost their jobs through no fault of their own. While the federal government plays a role in funding and administering these programs, the impact of a shutdown on UI benefits varies from state to state. Some states may have sufficient reserves to continue payments, while others may face delays or disruptions.

- Social Security Disability Insurance (SSDI): SSDI is a federal program that provides benefits to individuals with disabilities who have worked in the past. Similar to SSI, SSDI benefits are considered mandatory and are generally exempt from the effects of a shutdown.

Potential Disruptions

While some cash aid programs are exempt from the direct effects of a shutdown, others may experience disruptions, especially if funding is not authorized in a timely manner. These disruptions can manifest in various ways:

- Delayed Payments: Even if funds are available, processing delays can occur due to reduced staff availability during a shutdown. This can result in delayed payments for beneficiaries, causing financial strain and uncertainty.

- Limited Services: During a shutdown, federal agencies may operate with a reduced workforce, impacting the efficiency and scope of services provided. This can lead to longer wait times, reduced hours of operation, and limited access to essential resources.

- Program Changes: In the event of prolonged shutdowns, states may need to make difficult decisions to ensure the sustainability of cash aid programs. This could involve reducing benefits, imposing stricter eligibility criteria, or even temporarily suspending certain programs.

Protecting Cash Aid Recipients

Recognizing the vulnerability of cash aid recipients during government shutdowns, advocacy groups and policymakers have taken steps to safeguard these programs. For instance, during the 2018-2019 shutdown, efforts were made to ensure that SNAP funding was prioritized, and states were encouraged to use contingency plans to continue operations.

Long-Term Implications

Beyond the immediate impact, government shutdowns can have lasting effects on the financial well-being of cash aid recipients. Delayed payments or reduced benefits can lead to increased reliance on credit, higher debt levels, and potential long-term financial instability.

Conclusion

The potential impact of a government shutdown on cash aid programs underscores the importance of stable and reliable funding for these essential safety nets. While some programs are better equipped to weather the storm, others may face significant disruptions, exacerbating the financial challenges faced by vulnerable populations. As we navigate the complexities of government funding, it is crucial to prioritize the needs of those relying on cash aid to maintain their economic stability and overall well-being.

Frequently Asked Questions

What happens to cash aid programs during a government shutdown?

+The impact on cash aid programs varies depending on the specific program and its funding structure. Some programs, like SSI and SSDI, are considered mandatory spending and continue to operate as usual during a shutdown. Others, like TANF and UI, may experience disruptions or delays in payments if funding is not authorized in a timely manner.

How can states mitigate the effects of a shutdown on cash aid programs?

+States can implement contingency plans to ensure the continuity of cash aid programs during a shutdown. This may involve using reserve funds, prioritizing certain programs, or seeking alternative funding sources. However, the effectiveness of these measures can vary depending on the duration and severity of the shutdown.

Are there any long-term effects of shutdowns on cash aid recipients?

+Yes, prolonged shutdowns can have lasting financial consequences for cash aid recipients. Delayed payments, reduced benefits, or disruptions in services can lead to increased debt, financial strain, and potential long-term economic instability. It is crucial to address these issues promptly to mitigate the impact on vulnerable populations.

What can individuals do to prepare for potential shutdown-related disruptions in cash aid?

+Individuals receiving cash aid can take proactive steps to prepare for potential disruptions. This may include building an emergency fund, exploring alternative sources of support, and staying informed about the specific impact of a shutdown on their benefits. Seeking financial counseling or support from advocacy groups can also provide valuable guidance during uncertain times.