In the hallowed halls of higher education, where the echo of ambition often collides with the stark reality of student debt, West Chester University’s tuition fees have become an unwelcome but unavoidable badge of honor. For those brave souls contemplating or navigating the labyrinthine corridors of tuition costs at West Chester, brace yourself—this is not just another dry financial report; it’s a satirical odyssey through the financial jungle that makes even the most seasoned economic theorists a bit queasy.

The Unvarnished Reality of West Chester Tuition: A Price Tag That Could Fund a Small Country

To truly grasp the scope of West Chester University tuition, one must first understand that it is less a fee and more a rite of passage—an arcane ritual involving formidable numbers, bewildering fee structures, and the occasional existential crisis. As of the latest academic year, undergraduate in-state students can expect to shell out approximately 11,500</strong> annually, while out-of-state undergraduates face a staggering <strong>17,000. For the uninitiated, these figures are reminiscent of a Hollywood blockbuster budget, yet the only thing they guarantee is a mountain of student loans that could later be used to buy a small island—or at least a really nice used car.

Breaking Down the Cost Components: Why Your Tuition is Basically a Monty Python Sketch

The tuition fee alone is but the tip of the iceberg. Beneath the surface lies a complex tapestry of ancillary costs—each more bewildering than the last. These include campus fees, meal plans, technology charges, health services, and of course, the infamous “miscellaneous” category that inevitably swells the total bill. To illustrate, a typical undergraduate might rack up an additional 2,000</em> in mandatory fees, transforming a seemingly reasonable 11,500 into a vast ocean of financial commitments.

| Relevant Category | Substantive Data |

|---|---|

| In-State Undergraduate Tuition | $11,500 per year |

| Out-of-State Undergraduate Tuition | $17,000 per year |

| Additional Mandatory Fees | Approx. $2,000 annually |

| Total Estimated Cost (Including Fees) | $13,500 (in-state), $19,000 (out-of-state) |

Historical Context: From Tuition Hats to the Modern-Day Blackjack Game

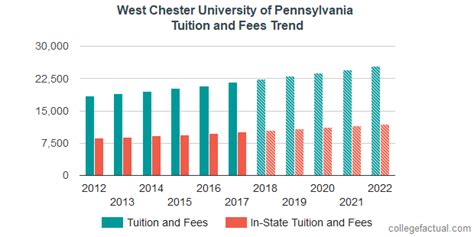

West Chester’s tuition trajectory is a fascinating case study in educational inflation—akin to a game of financial poker where the house continually raises the stakes. Since the early 2000s, tuition has ballooned approximately 3-5% annually, outpacing inflation and wage growth. This relentless upward march mirrors broader trends across American higher education, where the cost of a degree has escalated faster than a caffeinated squirrel on a sugar rush.

The Evolving Price Tag: From Moderate Fees to Financial Obstacle Courses

Back when tuition at West Chester hovered around $4,000, students could afford a semester without mortgaging their future. Today, that same student might need to take out a second mortgage or sell a kidney to cover costs—though, in fairness, the university does not officially endorse selling organs on the black market.

| Historical Tuition Data | Year | Cost |

|---|---|---|

| Undergrad In-State Tuition | 2000 | $4,200 |

| Undergrad In-State Tuition | 2023 | $11,500 |

Financial Aid and Scholarship Strategies: Your Guide to Dancing Through Dollar Hoops

For intrepid students, the path through West Chester’s tuition maze involves navigating the tumultuous waters of scholarships, grants, and loans. The university offers a suite of financial aid programs, but the catch is—these are often competitive, limited, or tied to maintaining a GPA that rivals a high-score gamer. Moreover, federal aid and private scholarships become drops in an ocean of rising costs, leaving students to perform financial acrobatics just to keep their heads above water.

Navigating Scholarship Landmines: Practical Tips for the Savvy Student

Firstly, applying early and often increases your chances. Second, a meticulously crafted essay can sometimes get you from “costly liability” to “financially manageable.” Third, don’t forget to explore niche scholarships related to your field of study or background—think of them as secret treasure chests hidden in the educational landscape.

| Funding Source | Average Award |

|---|---|

| Need-based Federal Grants | $6,000 per recipient |

| Merit-based Scholarships | $3,000–$10,000 |

| Private Scholarships | Varies widely, up to full-ride |

| Student Loans | Up to $20,500 federal Stafford limits annually |

Impact of Tuition Hikes on the Student Body and Broader Community

While students grapple with sticker shock, the ripple effects extend into the larger community—affecting local economies, housing markets, and even the mental health of the young scholars burdened with debt. West Chester’s rise in tuition has subtly shifted demographics—tending toward wealthier cohorts able to absorb costs and leaving behind those who might have previously considered higher education a viable option.

Socioeconomic Consequences: An Unintended Segregation?

Ironically, the very price tag that promises academic prestige can also serve as a barrier, creating a sort of educational gated community. The long-term consequences include decreased socioeconomic diversity, which, if left unchecked, risks turning West Chester into a university with an elite aura—an exclusive club accessible only via Swiss bank accounts.

| Impact Measure | Indicator |

|---|---|

| Enrollment Trends | Decline among low-income students by approximately 15% over the decade |

| Local Economy | Increased student spending on housing—upward of 20% in some neighborhoods |

| Student Debt Levels | Average debt upon graduation around $37,000, with some reaching six figures |

Strategies for Making the Most of Your Money at West Chester

In the grand tradition of college survival, students must master more than just their coursework—they must become savvy financial strategists. Budgeting meticulously, leveraging community resources, and perhaps most importantly, developing a steel trap memory for deadlines and scholarship opportunities are essential skills. Additionally, exploring part-time work or cooperative education programs can help buffer the financial blow, turning the student experience into an entrepreneurial venture of sorts.

Budget Hacks for the Frugal Scholar

- Sign up for campus meal plans with flexible options—because that overpriced coffee doesn’t pay for itself

- Utilize student discounts everywhere—from tech gadgets to local eateries

- Rent textbooks instead of buying—your wallet will thank you, and your bookshelf will thank you less

- Consider living off-campus if it lowers overall expenses, despite the romantic allure of dorm life

Conclusion: The Cost of Knowledge and the Currency of Experience

In the end, West Chester University’s tuition fees serve as a modern-day Gordian knot—complex, expensive, and cutting just enough to inspire innovation, desperation, or both. Navigating this landscape requires not only academic prowess but also a healthy dose of humor, resilience, and strategic planning. For every dollar and each sleepless night, there’s a future being shaped—perhaps just not in the way initially envisioned, but in a way that teaches more about resourcefulness than about the value of money itself. So, whether you’re a prospective student, a curious observer, or a seasoned academic, remember: the true tuition is paid in life lessons, laughter, and the occasional sarcastic remark about the costs of modern education.

Key Points

- West Chester tuition has risen over 170% since 2000—outpacing inflation significantly.

- Additional fees and ancillary costs can double or even triple initial estimates, transforming affordable education into a financial Everest.

- Effective financial planning, scholarships, and resourcefulness are essential for navigating tuition burdens.

- Tuition hikes influence socioeconomic diversity and local economies, with long-term societal implications.

- Students benefit from strategic budgeting and leveraging campus resources to maximize their educational investment.

How much does it typically cost to attend West Chester University as an in-state undergraduate?

+Currently, in-state undergraduates pay approximately 11,500 annually in tuition, with additional fees bringing the total to around 13,500 per year.

Are there significant financial aid options available for students struggling with tuition?

+Yes, students can access federal grants averaging $6,000, merit-based scholarships, private awards, and federal student loans. However, competition and application timing are critical.

What has been the trend in tuition increases over the last two decades at West Chester?

+Tuition has increased by over 170% since 2000, outpacing inflation and adding a hefty premium to education costs, making affordability a growing concern.

How does rising tuition affect the socioeconomic diversity at West Chester?

+Higher costs tend to deter low-income students, leading to decreased socioeconomic diversity and raising questions about the accessibility of higher education in the region.

What are practical tips for students to manage or reduce their education costs?

+Students should explore scholarships early, utilize student discounts, rent textbooks, consider off-campus housing, and develop disciplined budgeting habits—transforming the student loan burden into an exercise of financial agility.