The government shutdown, a situation where non-essential federal government operations cease due to a lack of congressional funding, can have wide-ranging effects on various aspects of the United States' administrative and economic landscape. Among the many federal agencies affected by such an event is the Internal Revenue Service (IRS), which plays a pivotal role in the nation's tax system.

The IRS is responsible for administering the nation's tax laws, collecting taxes, and enforcing compliance. Its functions are critical to the stability and operation of the US economy. Therefore, a government shutdown can significantly impact the IRS's operations and, consequently, taxpayers and the broader economy.

Understanding the Impact on IRS Operations

During a government shutdown, the IRS is often forced to furlough a significant portion of its workforce, which can lead to a reduction in services and operational capacity. This impacts the agency’s ability to process tax returns, issue refunds, and provide assistance to taxpayers.

For instance, during the 2018-2019 government shutdown, the IRS was forced to furlough around 46,000 employees, which represented about 69% of its workforce. This resulted in delays in processing tax returns, particularly those with complex issues or errors, and a backlog of refunds.

Processing Delays and Backlogs

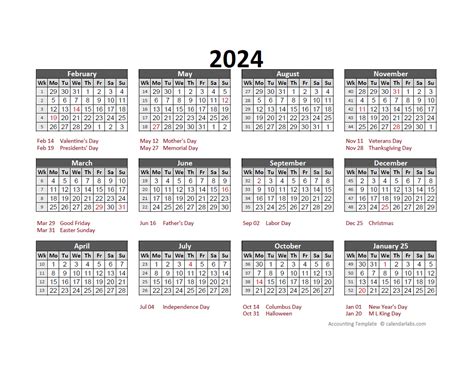

The IRS typically receives millions of tax returns during the filing season, which usually begins in January and ends in mid-April. However, during a government shutdown, the agency may not have the necessary staff to handle the influx of returns, leading to processing delays.

| Shutdown Period | Number of Returns Processed |

|---|---|

| 2018-2019 Shutdown | 15.2 million |

| 2013 Shutdown | 2.4 million |

| Average Processing per Day (Non-Shutdown) | 1.6 million |

As the table illustrates, the 2018-2019 shutdown resulted in a significant slowdown in the processing of tax returns, with only about 15.2 million returns processed during the shutdown period. This is in stark contrast to the average daily processing of about 1.6 million returns during a typical non-shutdown period.

Refunds and Taxpayer Assistance

A government shutdown can also delay refunds for taxpayers. During the 2018-2019 shutdown, the IRS was unable to issue refunds for about 3.7 million tax returns. This caused financial strain for many taxpayers who rely on their refund to cover expenses or pay off debts.

Moreover, the IRS's taxpayer assistance programs, which provide help to individuals with tax questions or problems, may also be affected. These programs, which include telephone assistance, in-person help at Taxpayer Assistance Centers, and online tools, may see reduced hours or even temporary closure during a shutdown.

Effects on Taxpayers

The effects of a government shutdown on the IRS are not limited to the agency itself. Taxpayers also experience significant disruptions and inconveniences during this period.

Tax Filing and Payment Deadlines

A government shutdown can impact tax filing and payment deadlines. In some cases, the IRS may extend the deadline for filing and paying taxes, providing some relief to taxpayers. However, this is not a guarantee and can vary depending on the length and nature of the shutdown.

For instance, during the 2018-2019 shutdown, the IRS announced that it would extend the tax filing deadline for individual taxpayers to April 15, 2019, for those who requested an automatic extension. However, this extension did not apply to estimated tax payments or corporate tax returns.

Financial Hardship

For many taxpayers, the delay in receiving refunds can cause financial hardship. Tax refunds can represent a significant source of income for some individuals and families, especially those with low or moderate incomes. Delayed refunds can impact their ability to pay for essential expenses, such as rent, groceries, or medical bills.

Uncertainty and Stress

A government shutdown creates an environment of uncertainty for taxpayers. They may be unsure about when they can expect their refund, whether they need to take alternative financial measures, or if their tax obligations will be impacted.

This uncertainty can lead to increased stress levels among taxpayers, especially those who are already dealing with financial difficulties. It can also deter taxpayers from seeking assistance from the IRS, as they may be concerned about the agency's limited capacity during a shutdown.

Future Implications and Preventative Measures

The impact of a government shutdown on the IRS and taxpayers underscores the need for a stable and reliable funding mechanism for the federal government. It also highlights the importance of the IRS’s role in the nation’s economy and the potential consequences of disruptions to its operations.

Potential Solutions

To mitigate the effects of future government shutdowns, several measures could be considered. One potential solution is to pass a full-year appropriations bill, which would provide funding for the entire fiscal year, thereby eliminating the need for stopgap funding measures that can lead to shutdowns.

Another approach could be to provide the IRS with a dedicated funding stream that is not subject to the regular appropriations process. This would ensure that the IRS has the necessary resources to continue its operations during a government shutdown, even if other agencies are affected.

Enhancing Digital Services

The IRS could also invest in enhancing its digital services and infrastructure. By improving its online tools and platforms, the IRS could reduce the need for in-person or telephone assistance, thereby minimizing the impact of a shutdown on taxpayer services.

Additionally, the IRS could consider implementing measures to streamline its processes and improve efficiency, such as automating more of its functions or implementing artificial intelligence technologies.

Public Awareness and Education

Lastly, public awareness and education about the potential impact of a government shutdown on tax obligations and refunds could help taxpayers prepare and manage their finances more effectively during these periods.

The IRS could provide clear and timely communication about any changes to tax deadlines, refund processes, or taxpayer assistance during a shutdown. This would help taxpayers make informed decisions and reduce the stress and uncertainty associated with these events.

How often do government shutdowns occur, and what causes them?

+Government shutdowns occur when Congress fails to pass funding bills or when the President vetoes them. They can happen when there are disagreements over budget allocations, policy issues, or other political disputes. Since 1976, there have been 22 shutdowns, with varying durations and impacts.

What is the typical process for filing taxes during a government shutdown?

+During a government shutdown, taxpayers can still file their tax returns online or by mail. However, the IRS’s processing of these returns may be delayed, and refunds could be postponed. The IRS typically provides updates and guidance on its website during a shutdown.

How does a government shutdown affect the tax filing deadline for individuals and businesses?

+The IRS may extend the tax filing deadline for individuals during a government shutdown, but this is not guaranteed. The impact on businesses can vary, and it’s important to stay updated with the IRS’s announcements and guidance during a shutdown.

What steps can taxpayers take to mitigate the impact of a government shutdown on their tax obligations and refunds?

+Taxpayers can take several steps, such as filing their tax returns early, using direct deposit for refunds, and exploring online tools and resources provided by the IRS. It’s also important to stay informed about any changes or updates during a shutdown.