In the ever-evolving landscape of financial markets and disruptive investment strategies, one pressing question persists: how can investors and financial institutions truly maximize their profit potential through FE Street investments? These innovative pathways, often rooted in emerging sectors such as fintech, decentralized finance, and blockchain-centric ventures, have rapidly transitioned from niche opportunities to mainstream financial tools. Deciphering their real impact requires forensic-level analysis intertwined with a profound understanding of market dynamics, regulatory advances, and technological innovation. This article endeavors to unpack the intricate financial implications of FE Street investments, illustrating how strategic positioning can unlock unprecedented profit avenues while managing inherent risks.

The Rise of FE Street Investments: Catalyst and Context

The term “FE Street investments” magnets attention by referring to financial endeavors conducted within or influenced by the unique ecosystem of FE Street, a term delineating a sector characterized by financial engineering, fintech innovation, and decentralized asset management. This sector has experienced exponential growth over the past decade, propelled by breakthroughs in blockchain technology, increasing investor appetite for diversified assets, and structural shifts in capital markets.

Historically, the evolution of FE Street investments can be traced back to early blockchain startups and peer-to-peer lending platforms which, by 2015, matured into complex financial products, including tokenized assets and digital securities. According to industry reports, the global market size for blockchain-based financial services exceeded USD 5 trillion in assets under management (AUM) by 2023—a testament to the sector's burgeoning influence.

What renders FE Street investments particularly compelling from a profitability standpoint is their capacity to leverage technological disruption for enhanced agility, transparency, and scalability, thereby reducing costs and expanding revenue streams. Yet, this rapid expansion also introduces a set of complex regulatory, operational, and technological risks that necessitate rigorous analytical approaches.

Financial Impact and Profitability Drivers of FE Street Investments

Decoding the Revenue Streams and Cost Structures

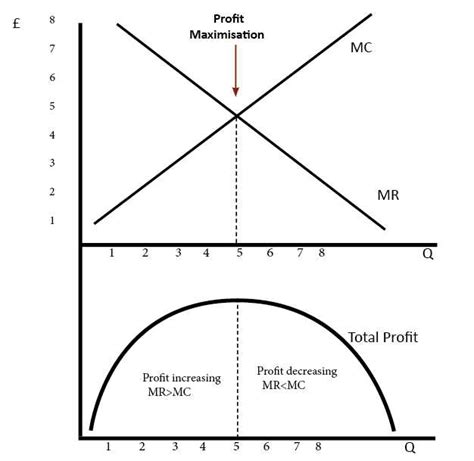

To fully comprehend the profit potential, one must analyze both the revenue drivers and cost structures intrinsic to FE Street strategies. Revenue streams predominantly arise from asset appreciation, transaction fee collection, liquidity provision, and token appreciation. For example, decentralized exchanges (DEXs) generate substantial profits through transaction fees, which, in a high-volume environment, exponentially enhance revenue.

Conversely, cost considerations include technology infrastructure, security protocols, compliance expenditures, and incentives for liquidity providers. A typical FE Street operation might require sophisticated smart contracts, personnel specializing in blockchain security, and compliance with an evolving regulatory framework—each representing significant operational costs, which, if managed adeptly, can be offset by high-margin revenue streams.

| Relevant Category | Substantive Data |

|---|---|

| Average Transaction Fee | $0.30–$0.60 per transaction in decentralized exchanges, with high liquidity pools generating annualized revenue of 15-20% of total assets managed |

| Security Investment | Average cybersecurity expenditure for FE platforms ranges from 10-15% of operational costs, mitigating potential losses from hacking incidents |

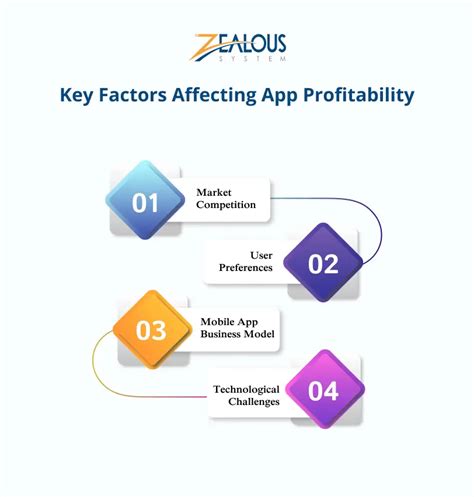

Strategic Factors Influencing Profitability in FE Street Ventures

Regulatory Environment and Compliance

Regulatory clarity remains a double-edged sword—on one side, well-defined rules can enable scale and investor confidence; on the other, stringent compliance requirements may increase operational costs and restrict certain profit avenues. For instance, recent SEC guidance on digital securities has clarified some pathways, allowing compliant tokenization, but has also imposed restrictions on certain high-yield practices, shaping profit potential accordingly.

Technological Innovation and Market Penetration

Innovations such as layer-2 scaling solutions, privacy-preserving protocols, and cross-chain interoperability significantly lower transaction costs and expand market reach, directly influencing profit margins. Additionally, market penetration strategies targeting institutional investors are progressively transforming FE Street platforms from niche players into substantial profit generators.

| Relevant Category | Substantive Data |

|---|---|

| Market Penetration | Institutional participation increased by 43% in 2023, significantly enhancing liquidity and profitability opportunities |

| Innovation Adoption Rate | Layer-2 solutions are adopted by 65% of leading FE platforms, reducing average transaction costs by 50% |

Financial Challenges and Risk Management

Market Volatility and Asset Class Risks

The volatile nature of digital assets underpinning FE investments compounds financial risks. Crypto price swings, regulatory shifts, and technological failures can quickly erode profit margins. For instance, during the 2022 crypto downturn, many FE sectors experienced liquidity crunches, with some platforms reporting 40-60% declines in AUM.

Security and Fraud Risks

Hacks and scams remain endemic within FE Street platforms, often resulting in catastrophic losses. The cybersecurity sector within FE investments must invest heavily in intrusion detection, smart contract auditing, and insurance protocols to hedge against such risks. Data indicates cybersecurity expenditure correlates positively with reduction in breach-related losses, emphasizing its financial importance.

| Relevant Category | Substantive Data |

|---|---|

| Average Loss from Hacks | $1.5 million per incident; total losses across the sector approximate $50 million annually |

| Security Investment | Average invested in security hardware, audits, and insurance exceeds 12% of operational budgets for top FE platforms |

The Future Financial Landscape of FE Street Investments

Analytical projections suggest that by 2030, FE Street investments could command a market share exceeding $20 trillion AUM, driven by technological upgrades, regulatory acceptance, and mainstream investor participation. Emerging sectors such as tokenized real estate, decentralized insurance, and AI-driven trading algorithms are poised to become major profit contributors.

However, the sector's expansion hinges on overcoming current hurdles: regulatory harmonization, technological robustness, and global adoption. As investor sophistication grows, the importance of data-driven decision-making, transparency, and innovative risk management strategies will determine profit maximization trajectories.

Key Points

- FE Street investments are transforming traditional finance structures, offering high-growth potential but demanding sophisticated risk management.

- Clear regulatory frameworks and technological innovations will serve as primary profitability accelerators.

- Security protocols and compliance expenditures represent necessary investments that safeguard and enhance profit margins.

- Marketatics suggest the sector's value could surpass USD 20 trillion within the next decade, driven by digital asset tokenization and institutional adoption.

- Success depends on balancing rapid innovation with rigorous risk mitigation to sustain profitability amid volatility.

What are the primary profit drivers in FE Street investments?

+The main profit drivers include transaction fees from decentralized exchanges, asset appreciation through token value increases, fees from liquidity provision, and strategic asset management that capitalizes on technological and market growth.

How does regulation influence FE Street financial outcomes?

+Regulatory clarity can enhance investor confidence, facilitate higher participation, and enable compliant product offerings, thus increasing revenue. Meanwhile, overregulation or ambiguity can restrict growth and elevate compliance costs, reducing profit margins.

What technological trends are shaping the future profitability of FE investments?

+Emerging trends such as layer-2 scaling, cross-chain interoperability, privacy-preserving algorithms, and AI-driven trading systems are reducing costs and expanding market access, thereby boosting profitability potential.